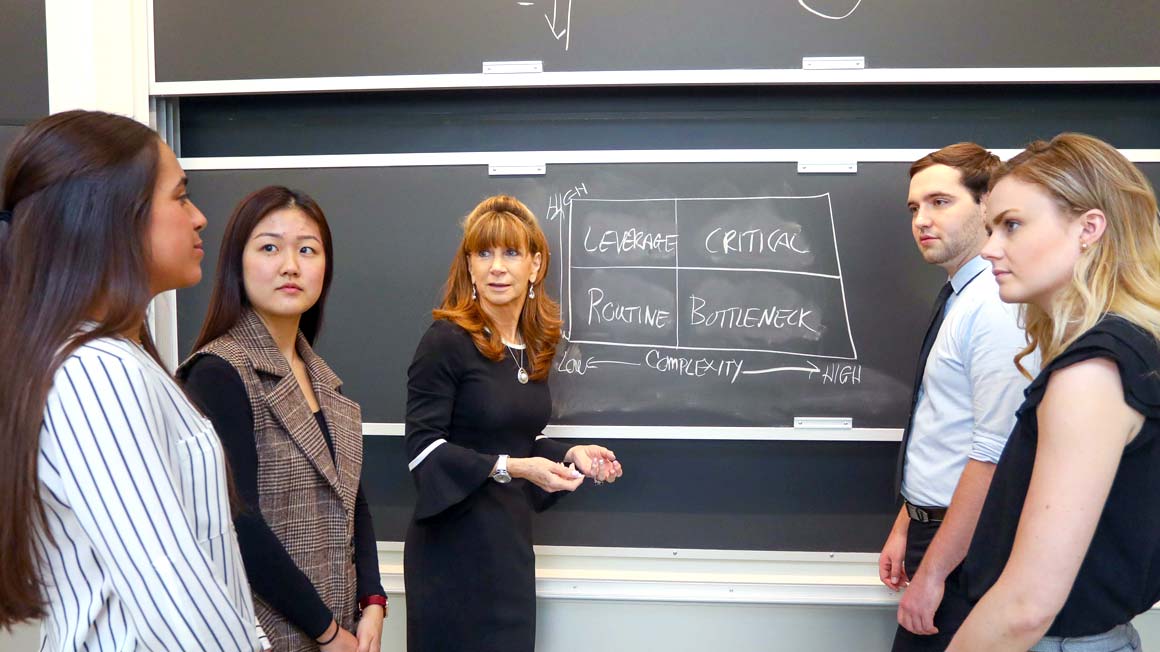

Teresa McCarthy, Ph.D., Professor of Marketing and co-founder of Bryant’s Global Supply Chain Management program, recently served as a panelist for the Institute of Business Forecasting & Planning webinar series, “Forecasting During a Pandemic.” The discussion on April 9, 2020, focused on Predicting Consumer Demand During A Crisis.

Established in 1981, the Institute of Business Forecasting & Planning (IBF) is a membership organization recognized worldwide as the premier full-service provider of demand planning, forecasting, business analytics, education, benchmarking research, corporate training, e-Learning, professional certification, world-class conferences, and advisory services.

McCarthy joined a group of thought leaders and top demand planning professionals to discuss how to understand how consumers and companies are adapting to a new reality. The group included Eric Wilson, CPF, Director of Thought Leadership, Institute of Business Forecasting; Mark Temkin, Senior Director, Planning and External Operations, Harry's Inc.; and Laura Foley, Global Consulting Leader, John Galt Solutions.

In this informative discussion, she addresses issues such as trends and shifts in consumer demand caused by the pandemic-driven economic slow-down. She also touches on brand loyalty, supply chain disruptions, and inventory management issues.

To follow are some key takeaways. The full panel discussion is available here>>>

Pre-pandemic retail sales were up, even brick and mortar

Before the pandemic, there was talk of a ‘retail apocalypse’ that never really happened. Overall, retail has been increasing at about 3.5 to 4 percent. The bulk of the growth is coming out of e-commerce which is in the 11 to 12 percent range. During the Christmas season, it was about a 14-plus percent range. Brick and mortar has been increasing at about 2 to 2.5 percent, even with the closing of unprofitable stores.

Before the pandemic, there was talk of a ‘retail apocalypse’ that never really happened.

Retail shift from brick and mortar to online sales

Since the emergence of the COVID crisis, we are obviously seeing a major shift from brick and mortar, which is closed for most of the country right now, into e-commerce, specifically 30 to 40 percent increases, which is tremendous growth. That shift is largely for the lower-margin goods as people are stocking up on staples. That's going to be an issue to be dealt with going forward.

The ‘home is haven’ trend that has emerged is expected to continue, certainly, in the short term.

Consumer behavior “home is haven” trend

Consumer behavior is changing, but we don’t know exactly how and for how long. It is something that can and should be tracked as closely as possible. The ‘home is haven’ trend that has emerged is expected to continue, certainly, in the short term. We can expect to see a shift in consumer behavior toward more “stay-at-home” consumer products including crafts, games, and fitness products.

Companies have to focus strategically on digital alternatives and brand building right now.

Companies creating a full consumer experience will see more engagement

While consumers wait to see what’s going to happen, the companies that are offering an online experience—not just a dot com purchasing option—but a more engaging e-commerce experience, will be more successful. For example, Peloton has been doing a good job at this for a while and is well positioned to target customers at home that are interested in fitness. Nike is offering all kinds of experiential options, such as the Nike Training Club app and the #PlayInside social media campaign, to engage customers. Some of it's free, some of it's not. But it's building brand loyalty. Companies have to focus strategically on digital alternatives and brand building right now.

We're going to see a shift toward basic investment in all kinds of quality goods, not just apparel, versus trendy one-time or short-time use products.

Fast fashion vs. slow fashion

Some retail trend watchers predict a decline in “fast fashion” consumption, with a shift to “slow fashion,” which means buying investment items instead of lower quality items that often end up in landfills. We're going to see a shift toward basic investment in all kinds of quality goods, not just apparel, versus trendy one-time or short-time use products.

Product distribution, particularly omnichannel

In terms of distribution channels, there are some unique challenges for omnichannel distribution. Omnichannel retailing provides consumers with a seamless shopping experience across multiple physical and digital sales channels through which they can purchase and receive orders.

For example, large retailers like Macy's and Zara, with hundreds or thousands of stores across the globe have made stores their point of distribution. This means the retailers use their physical store locations to pick, pack, and ship online orders, or customers can pick up items purchased online. This allows retailers to have product located closer to the customer and deliver faster in order to better compete with Amazon. With most stores closed because of the pandemic, retailers have to decide how online purchase will be delivered to the consumer. These distribution issues, as well as uncertain demand, can not only make it difficult to plan, but also drive up costs at a time when sales are declining.

It’s difficult to plan when no one knows when stores and other parts of the economy will open.

Inventory management

In the short-term, managers are trying to figure out what do with the inventory in their stores and their distribution centers. It’s difficult to plan when no one knows when stores and other parts of the economy will open. China shut down production facilities for 45 to 60 days, so there is going to be a big gap in the pipeline. Very tactical decisions have to be made about existing inventory and how to replenish when it’s depleted. Some of the basic staple goods will be saleable. But there are many more categories of products, particularly seasonal goods, that may not be.

Going forward

There are many unanswered questions in these challenging times, and this panel discussion has addressed only a small part of the long-term global picture. The global supply chain is a linchpin of a prospering economy. The nearly unprecedented levels of uncertainty in the marketplace makes it difficult for businesses at every level to operate and plan for the future. Some companies are getting creative and developing innovative ways of doing business, as are many individuals. It is the hope that as the economy opens up and consumer demand increases, U.S. businesses can realign strategies and get on a path to recovery and growth.

The full webinar offered by Institute of Business Forecasting featuring Professor McCarthy is available online here>>>