Preparing for the future means doing what you can to protect it. The Bryant University/International Corporate Governance Network (ICGN) Partnership Launch event on March 28 brought together scholars and experts from Bryant, IGCN, and the broader investment community to discuss one of the most pressing issues of our time: ensuring that financial investment can serve the common good as well as the bottom line.

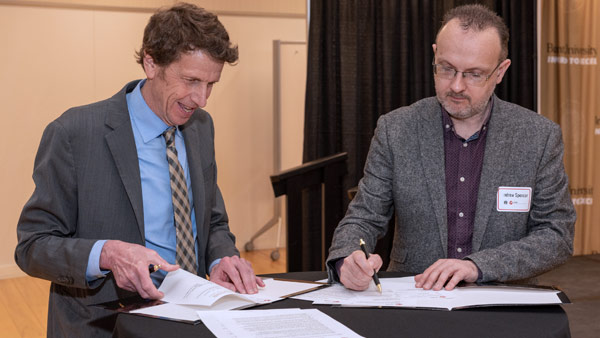

Held in Bryant’s Quinlan/Brown Academic Innovation Center and shared with more than 200 virtual attendees from 21 countries across 6 continents, the event formalized a strategic partnership between Bryant and ICGN, a coalition of investors from more than 50 countries who collectively manage more than $17 trillion and work toward promoting global corporate governance standards. In addition to discussions and keynote speeches that furthered the dialogue regarding the role that environmental, social, and governance (ESG) factors should play in responsible fiduciary stewardship, the launch event also included a memorandum of understanding signing between Bryant University President Ross Gittell, Ph.D., and Andrew Spencer, ICGN's training and education director.

The signing marked a bold new era for both parties, both Gittell and Spencer noted. This summer, governance professionals can enhance their knowledge and competencies through a Governance, Stewardship, and Sustainability Program offered through Bryant's Executive Education and Career Accelerator and delivered by international ICGN instructors.

“This partnership between Bryant University and ICGN takes the course to a new level, including accreditation and further development of content with access to Bryant and ICGN's expertise,” said Gittell.

Added Spencer, “We have been seeking a partner for some time to help us take it up another notch, and I think the evidence I’ve seen of the environment here and the discussions I've had at Bryant today suggest that we have found the right one.”

The day’s panel discussions centered around exploring the evolving role that topics of corporate governance, sustainability, and stewardship play within the investment industry, including higher education's role in preparing professionals to take the lead on ESG issues. Here are few of the most important takeaways from those discussions:

Investors should consider long-term impact

"These issues aren't going to just impact us 10 years from now or 20 years from now. We're going to see a huge long-term impact, as the UN climate report showed us a few weeks ago. And that's a scary thought. I have a three-year-old and a two-month-old baby, and I want to be able to show them what we're doing to create sustainability for them and for future generations." James Diossa, General Treasurer of the State of Rhode Island

ESG investing can make an important difference

"Just in the United States, institutional investors represent around 80 percent of the capitalization of the U.S. stock exchanges and that's about $30 trillion, just in this country. This really speaks to the latent power of institutional investors as a voice of capital to influence corporate behaviors either for good or potentially for ill." Keynote speaker George Dallas, ICGN Policy and Education Advisor

Market forces set the pace for investment

“Market forces themselves are helping people to understand that this is important. Because if investors are asking for something from a company, if you want people to continue to invest in you, you have to meet those needs. These issues are definitely real and it's definitely something that’s brought up.” Joshua Paton '19, Senior Analyst, Knights of Columbus Asset Advisors

Portfolio diversity is key

“Whether it's COVID-19 or geopolitics, the way the world has been set up from a global supply chain standpoint has been totally disrupted. And there's lots of thought leaders out there that have different theses on how the world will look going forward. I think what we've learned, from COVID and geopolitics and sourcing issues, and more recently from things like the collapse of Silicon Valley Bank, is that you can't have a single source of potential failure. You need to be diversified in how you actually run and build your business.” Scott Voss ’92, P’25, Managing Director, HarbourVest, Bryant University Trustee

Opportunity and evaluation go hand in hand

“I think the single most important word, when we think about ESG, is ‘opportunity.’ When you are looking at things through that risk lens, or at how to evaluate challenges in the future, I think you have a better sense of where you are and where you might need to end up. And I think that that opportunity for evaluation and that potential to look through those different lenses from where you sit right now is really the essence of ESG.” Carol Nolan Drake, Governance & Stewardship Policy Manager, ICGN

ESG education advances both students and industry

“What's important to note is that ESG investing is a spectrum; it's not one-size-fits-all. And in order to determine how to best invest your client's capital and incorporate these factors, you have to know what has been out there before and what other strategies have been implemented, which I think is part of the role higher education can play. If you come in with that base of knowledge and understanding of what the industry has done in these areas, as well as where the industry is headed, you're better able to contribute at an early stage to conversations that are happening across the board.” Scott Tibert ’18, Investment Director, Cambridge Associates

"Currently every stock pitch we have in the Archway Investment Fund, whenever students are presenting to include a holding in our portfolio, includes ESG discussion from multiple sources. The students learn they have different data sources available to them and how to come up with their own understanding in the end, which is very important." Asli Ascioglu, Ph.D., Chair and Professor of Finance, Coordinator for the Financial Markets Center and the Archway Investment Fund